“An essential aspect of creativity is not being afraid to fail” – Edwin Land

Look, we’ve all seen it. Business owners who are absolutely killing it in their field, but the moment someone mentions GST or tax obligations, they get that deer-in-headlights look.

It’s not their fault. Most people start businesses because they’re passionate about what they do – building, consulting, designing, creating. Nobody wakes up thinking “I can’t wait to reconcile my accounts today.”

But here’s what we’ve learned from running financial literacy workshops: when business owners finally understand the money side, everything changes.

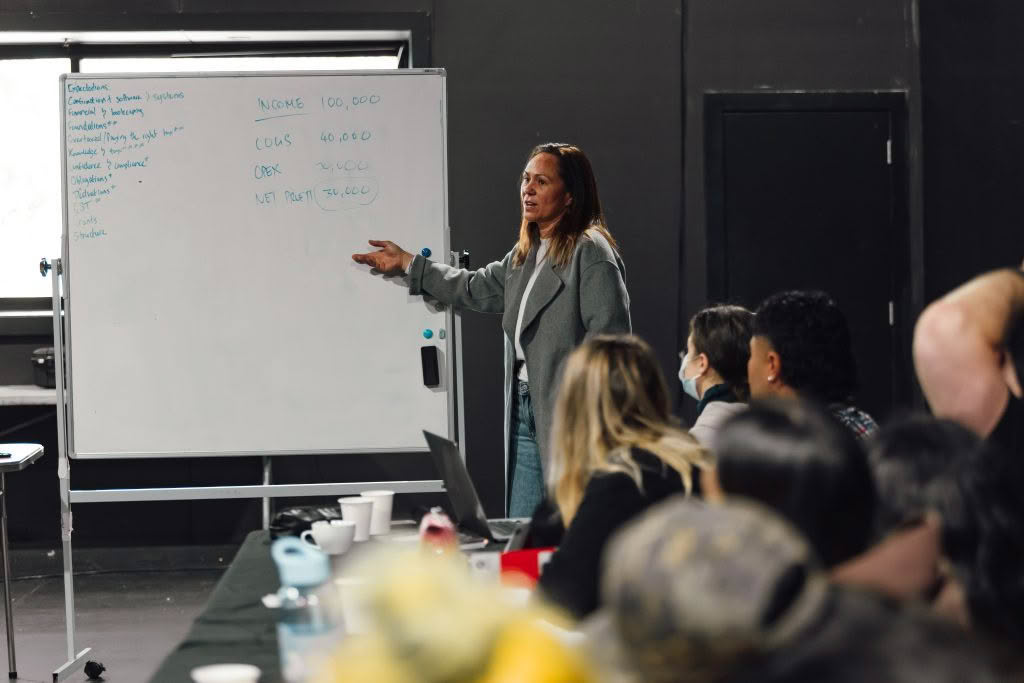

With support from ANZ and in partnership with Te Pou Theatre, we recently delivered a hands-on financial literacy workshop that tackled the real issues sole traders and small business owners face every day.

Here’s what people said:

That feedback tells the whole story. When compliance gets explained properly, it stops being scary and starts being useful.

We don’t lecture. We don’t use jargon. We don’t pretend everyone learns the same way.

Instead, we work with your people to break down exactly what they need to know. Here’s a brief insight into one of our financial literacy workshops:

Understanding what it actually means to be a sole trader and the key obligations that come with it.

The practical stuff you need to know to stay on top of tax and GST without the stress.

How to make KiwiSaver and ACC work when you don’t have an employer sorting it for you.

Simple, practical systems for invoicing, record-keeping, and staying organised, allowing you to focus on the mahi that matters.

When the business owners in your network are financially stressed, it affects everything. They undercharge for their work. They miss opportunities. Some even leave their industries altogether.

But when they understand the basics, they operate from confidence instead of confusion. They price properly. They plan ahead. They focus on growing their businesses instead of just surviving them.

Industry Bodies & Trade Associations

Business Development Organisations

Education & Training Providers

Every organisation has different needs. Some want intensive on-site sessions. Others prefer online delivery. Some need industry-specific content. Others want general business fundamentals.

We adapt to what works:

As a Māori and Pasifika firm, we get that business isn’t just about individual success. It’s often about whānau, community, and values that go beyond profit margins.

We understand that business decisions frequently involve whānau considerations. That success means different things to different people. That cookie-cutter advice doesn’t always fit real situations.

Whether we’re working with construction contractors, consultants, retailers, or any other industry, we bring that understanding to every session.

The business owners in your network deserve better than trying to figure this stuff out from random Google searches and outdated Facebook advice.

They need straight answers from people who understand their world. They need practical systems they can actually implement. They need confidence instead of confusion.

Email us at info@weaccounting.co.nz or call 09 378 9207. We’ll have a proper kōrero about what your people need and how we can deliver it effectively.

Because when business owners understand the financial fundamentals, everyone wins. They succeed, their families benefit, and your organisation’s network gets stronger.

Ready to transform financial confusion into business confidence? Get in touch and let’s make it happen.